Parties and observers to the United Nations Framework Convention on Climate Change have descended on Marrakesh this week to work through the details of the agreement made last December in Paris. Part of the agreement relates to the finance transferred from developed to developing countries to support mitigating and adapting to the effects of climate change.

Here are three key developments in this year:

1. Developed countries have set themselves targets

Since 2009, developed countries have agreed and reiterated a figure of $100 billion a year to be spent in developing countries by 2020. The sources of this finance are not defined, so what’s counted depends on the country. Despite the uncertainty, the goal posts are set, and meeting this target is crucial: it’s a marker of trust and faith in the UNFCCC process to address the effects of climate change.

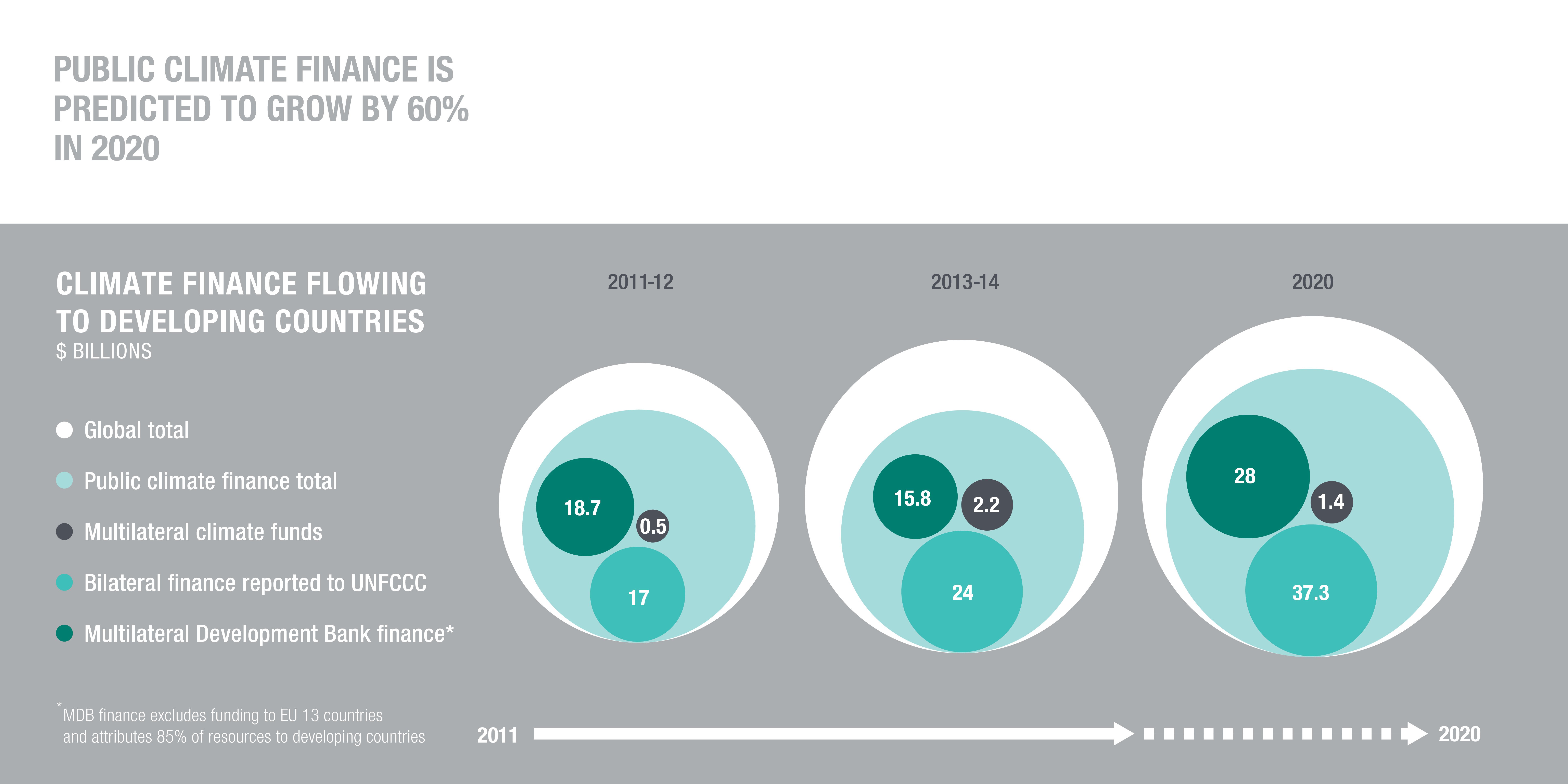

In the run up to last year’s climate talks, developed countries and Multilateral Development Banks (MDBs) committed to increasing the amount of finance they provide. The recently released Roadmap to $100 billion consolidates many of these plans, and predicts that the public money flowing to developing countries for climate action will hit $67 billion in 2020. That’s a 60% increase in just three years.

2. Climate finance flows are increasing

The UNFCCC Standing Committee on Finance’s Second Biennial Assessment and Overview of Climate Finance Flows, the BA 2016, shows bilateral climate finance is on the rise, increasing by 40%. Similarly, finance flowing to developing countries through the climate funds has increased four-fold.

In contrast, however, finance flowing through the MDBs to developing countries declined by about 10% between 2011 and 2014. Despite this, public climate finance flowing to developing countries was an estimated $42 billion in 2014. This is a 16% increase on 2011-12 figures.

3. There is work to be done to meet the targets

The growth in public climate finance flows is promising, but we cannot be complacent about meeting the $100 billion target.

In particular, the decline in MDB finance illustrated by the BA 2016, is in contrast with the 77% increase in climate finance expected from them between now and 2020. We need to understand how they – and others – will meet the OECD’s projected doubling of adaptation finance by 2020. With just 25% of public finance provided to developing countries channelled towards adaptation, this goal is important. We need to know exactly what should be funded.

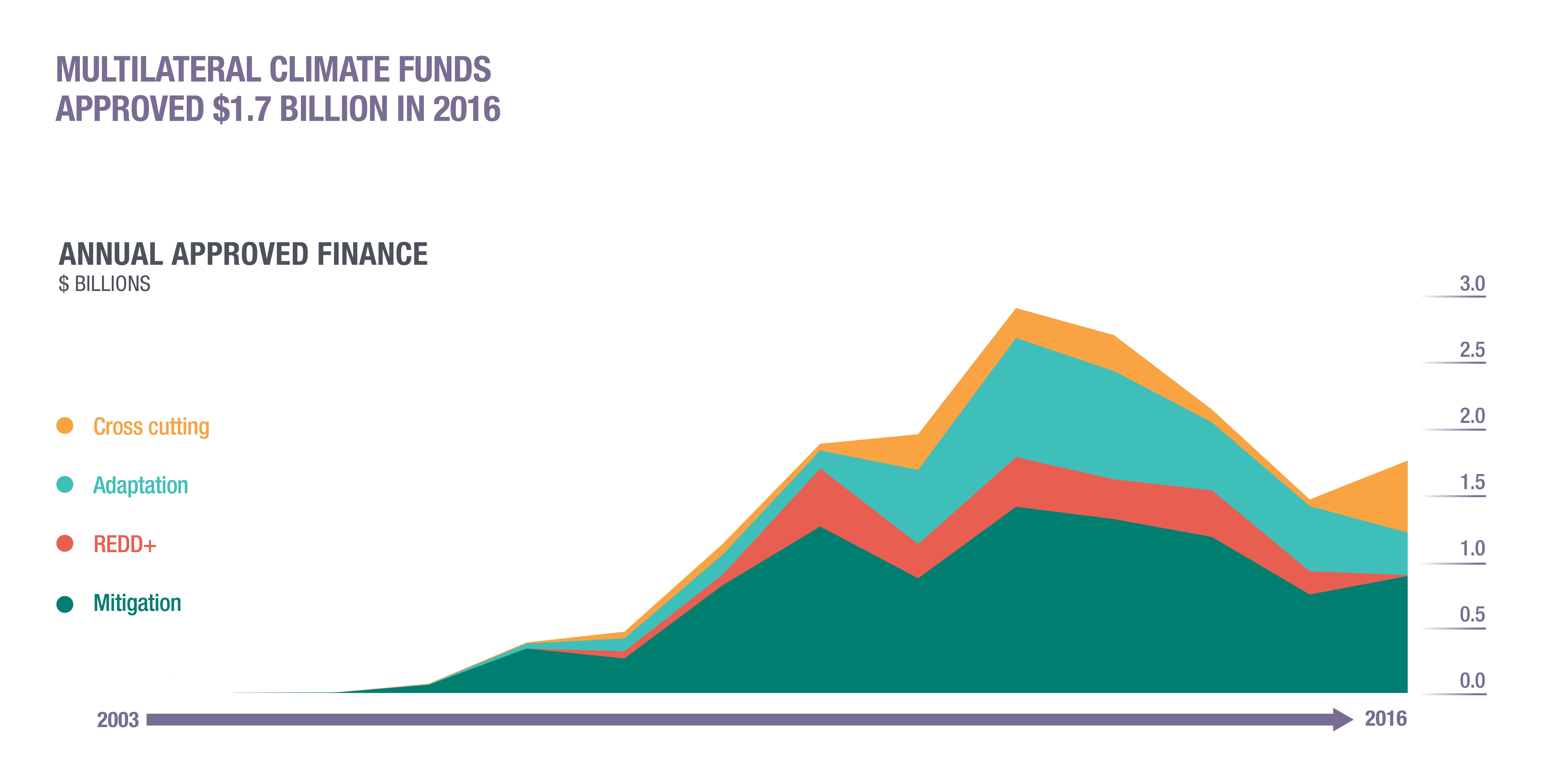

Although a fraction of the pie in 2020, the multilateral climate funds also still have work to do. They must pioneer new approaches: taking risks to support innovation, channelling finance to the most vulnerable countries and working to address the balance between financing mitigation and adaptation efforts in climate finance programming.

The newest fund of the UNFCCC, the Green Climate Fund (GCF), is making progress to this end. It approved over $1 billion for project activities and provided 55% of adaptation finance from climate funds just this year. But to make sure that its projects are transformational, the Funds’ risk appetite and investment framework must be finalised.

In addition to meeting the target it is imperative that we use that $100 billion well. At the heart of the Paris Agreement is the shifting of the global economic and development paradigm so that all flows of finance – public, private or blended; domestic or international – are consistent with keeping global warming under 2°C. With three years to go we mustn’t lose sight of this ambition.