In this month's public finance and development round-up I highlight discussions on measuring institutional improvement, medium-term budgeting, management and incentivisation, public-private partnerships and illicit financial flows.

The ‘form versus function’ debate hits the Washington Post

An article in the Washington Post asks how the new administrator of the U.S. Agency for International Development (USAID) can support institution building. It argues that donors and recipient governments both need to demonstrate the success of aid and so choose easy-to-achieve targets of institutional performance, rather than measuring how they actually function. The author’s paper finds that ‘countries able to access grants and highly subsidized loans are more likely to select cosmetic measures of success in institution-building. But countries that receive close-to-market-rate loans are more likely to select meaningful measures of institutional performance.’ It suggests that unless this is resolved then efforts to strengthen institutions are unlikely to succeed.

There may be some truth in this, but it may also simply be more difficult to come up with metrics of institutional performance in lower income contexts when pre-existing monitoring and evaluation systems are that much weaker. Of course the international community should be doing better when it comes to measuring institutions, but more work is needed on the nuts and bolts of how this might be done in practise.

Problems with medium-term budgeting may not be overcome by better ‘sequencing’

The medium-term budget has taken on a totemic quality in public finance debates. The latest contribution is an IMF evaluation of medium-term budgets in six African countries. It finds ‘early successes in introducing medium-term budgets were not sustained, and budgetary outcomes did not improve’. The evaluation finds large discrepancies between planned budgets and actual spending (relative to advanced countries) and argues that efforts to introduce medium-term budgets should be more carefully sequenced in future.

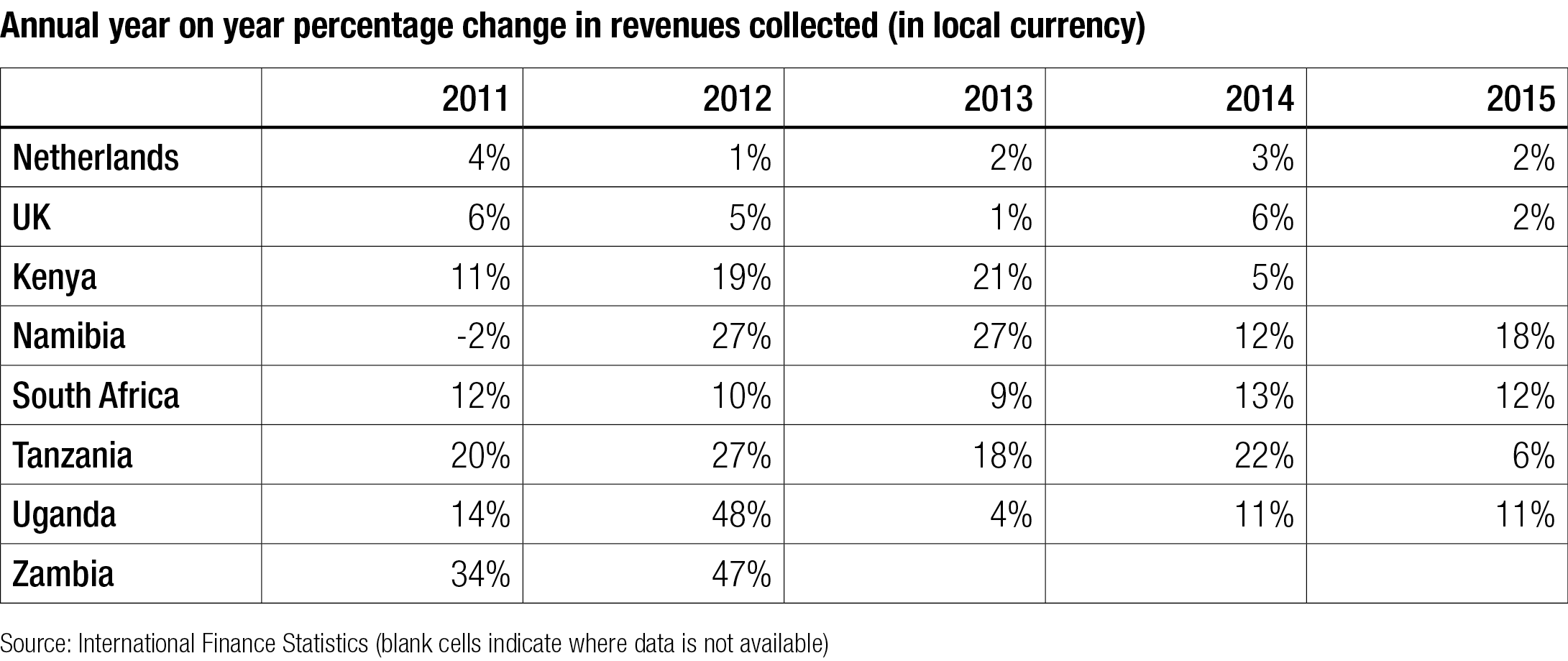

I agree that countries should be more critical when introducing medium-term budgets. But I am not sure current challenges can necessarily be overcome by better engineering of reform plans. Do problems arise because of bad forecasting in the countries surveyed, or simply because their economic performance is much more volatile? I think data on revenue performance points to the latter. The value of making medium-term spending plans will always be less when future economic performance is harder to predict.

If you would like to sign up to receive the public finance resources round-up regularly, please email Mark Miller ([email protected]).

We need to talk about management

It is commonly thought that introducing performance incentives is key to making bureaucrats work more effectively. Yet a new study from Rasul, Rogger and Williams suggests quite the opposite. They find that in both the Ghanaian and Nigerian civil services ‘granting bureaucrats more autonomy is positively associated with the effectiveness of bureaucracies, while management practices related to the provision of incentives or monitoring are negatively associated with their effectiveness’. It would be great to see more of this kind of work that looks at variations within governments instead of across governments. Getting the worst ministry to perform as well as the best is a much more motivating endeavour than asking poor countries to be ‘more like Denmark’.

What can we learn from current debates on the UK’s private finance initiative (PFI)?

The UK Labour Party’s proposal to nationalise existing PFI contracts has brought public private partnerships (PPPs) back in to the UK media. This FT article sets out why the private finance initiative has fallen from grace. Much of the initial enthusiasm for PPPs can be traced back to, essentially, an accounting trick. At the time, it enabled the UK government to build infrastructure without it being labelled as government borrowing, even though they were committed to repaying the private capital used to fund the project.

You can see parallels in the language of the financing for development debate where ‘blended finance’ can help turn ‘billions to trillions’. Discussions of how the trillions will be repaid tend to be overlooked. PPPs do potentially have a significant role to play. But endorsement should be on the grounds of whether they are a more efficient mode of delivery (which may well be the case), not because they help to get around borrowing limits.

Why understanding ‘the size of the prize’ matters for debates on illicit financial flows

Working to tackle illicit financial flows is clearly a worthwhile endeavour, but are current efforts commensurate with the benefits? In two new blogs, on trade misinvoicing and transfer pricing, Maya Forstater suggests current debates are based on inflated expectations. Coming up with reliable estimates for this stuff is not easy, but I fully agree with her on the importance of trying. As she suggests ‘relying on bad numbers undermines understanding, debases political debates, and erodes organisational integrity and is likely [to] lead to ineffective action.’

Keeping with the ‘prize’ analogy, I wonder whether the probability of actually ‘winning the prize’ is greater than some of the other numbers thrown around in the wider debates on development financing. Maya’s blog on transfer pricing shows that programmes like Tax Inspectors Without Borders are having some concrete successes even if they are not in line with some of the initial figures banded around. Although it is technically complex stuff, you could see how closing compliance gaps among multinationals might be more politically appealing than, for example, getting market traders to pay all their taxes.