Financial access in Africa has been on the rise in the last decade. It has a critical role to play in increasing the resilience of households and supporting their livelihoods. Maintaining this role is vital to tackle welfare and income losses stemming from the Covid-19-sparked economic crisis.

The financial impact of the pandemic is threatening to reverse gains made in per capita income. This could lead to negative coping mechanisms with damaging effects on both short- and long-term poverty.

In particular:

- In most countries in Africa, more than half of all households are reporting reduced incomes, with low-income households suffering the worst.

- Negative coping mechanisms for low-income households include reducing food consumption, an inability to buy medicine and children no longer attending school.

- Remittances – usually an important source of support for consumption and informal businesses for low-income households – have fallen by 20% and the World Bank project they will fall further.

Access to finance is essential to support low-income households

Against this backdrop, financial access is vital to supporting African households and businesses. As significant academic evidence – including from the FCDO and ESRC supported Development and Economic Growth Research Programme – has shown, it can bolster household resilience by smoothing consumption through access to savings or loans to help overcome the Covid-19 shock.

Financial access is also proving critical for delivering cash or in-kind transfers to vulnerable households through mobile platforms. This has meant assistance can be delivered rapidly, while policy responses are cheaper to implement and supportive of social distancing.

In turn this enables better short-term coping mechanisms for households, such as maintaining nutrition and rapid income recovery. There are also long-term benefits, such as more children remaining in or returning to school.

But the microfinance institutions delivering it are under pressure

Maintaining these supportive effects of financial access is, however, entirely dependent on upholding stability and liquidity in the microfinance sector. Here, the news is more negative.

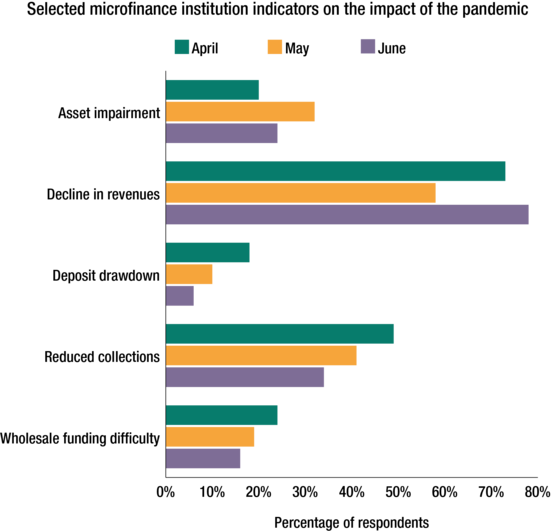

Rapid response surveys by the Consultative Group to Assist the Poor (CGAP) and the SME Forum show that microfinance institutions (MFIs) are dealing with rising ‘bad debts,’ which now make up to 30% of their total loans. This is sharply curtailed by new business and the difficulty in collecting payments from customers.

However, the majority of MFIs remain reasonably sound financially and widespread bankruptcies are not expected at this time.

As I have previously written, this indicates that there will not be a systemic crisis, but that MFIs ability to extend new lending and maintain asset quality is being hugely impaired.

In other words, without policy support, it is likely that there will be a sharp ‘credit crunch’ in lending to low-income households as well as small and micro businesses – threatening to trap them in or return them to poverty over the long-term.Donors need to maintain support for microfinance

Given this situation, donors must take action to ensure financial access for households and businesses in Africa is maintained. To do this, they should be ready to provide liquidity for MFIs with a track record of sound business and of delivering services to low-income households in particular, and microbusinesses.

They should also consider making investments in institutions with good long-term prospects through equity and subordinated debt, which reduces the burden of alternative sources of finance. Donors must also bolster their capital base and liquidity position to help ensure they can re-start lending as soon as possible.

Looking ahead, the Covid-19 crisis is accelerating the use of digital platforms for financial services and the broader digitalisation of the economy because of its advantages of offering remote services and business activity. Donors should support institutions which have strong capabilities in digital platforms to extend access, scope and the sophistication of those platforms.

Overall, microfinance is proving critical in supporting low-income households through the acute phase of the pandemic – especially in stopping them from falling back into extreme poverty or resorting to damaging coping mechanisms – and can support an inclusive recovery in the longer-term. Donors must stay on course in supporting them as part of the drive to ‘build back better’ in developing economies.