In order to reach net zero by 2050, the global economy must undergo a fundamental shift towards a low-carbon, climate-resilient (LCCR) model. Emerging market and developing economies (EMDEs) will likely need to invest upwards of $1 trillion per year to finance this transition, and while the G20 has long been focused on enhancing this flow of capital, international progress has been far off the pace required.

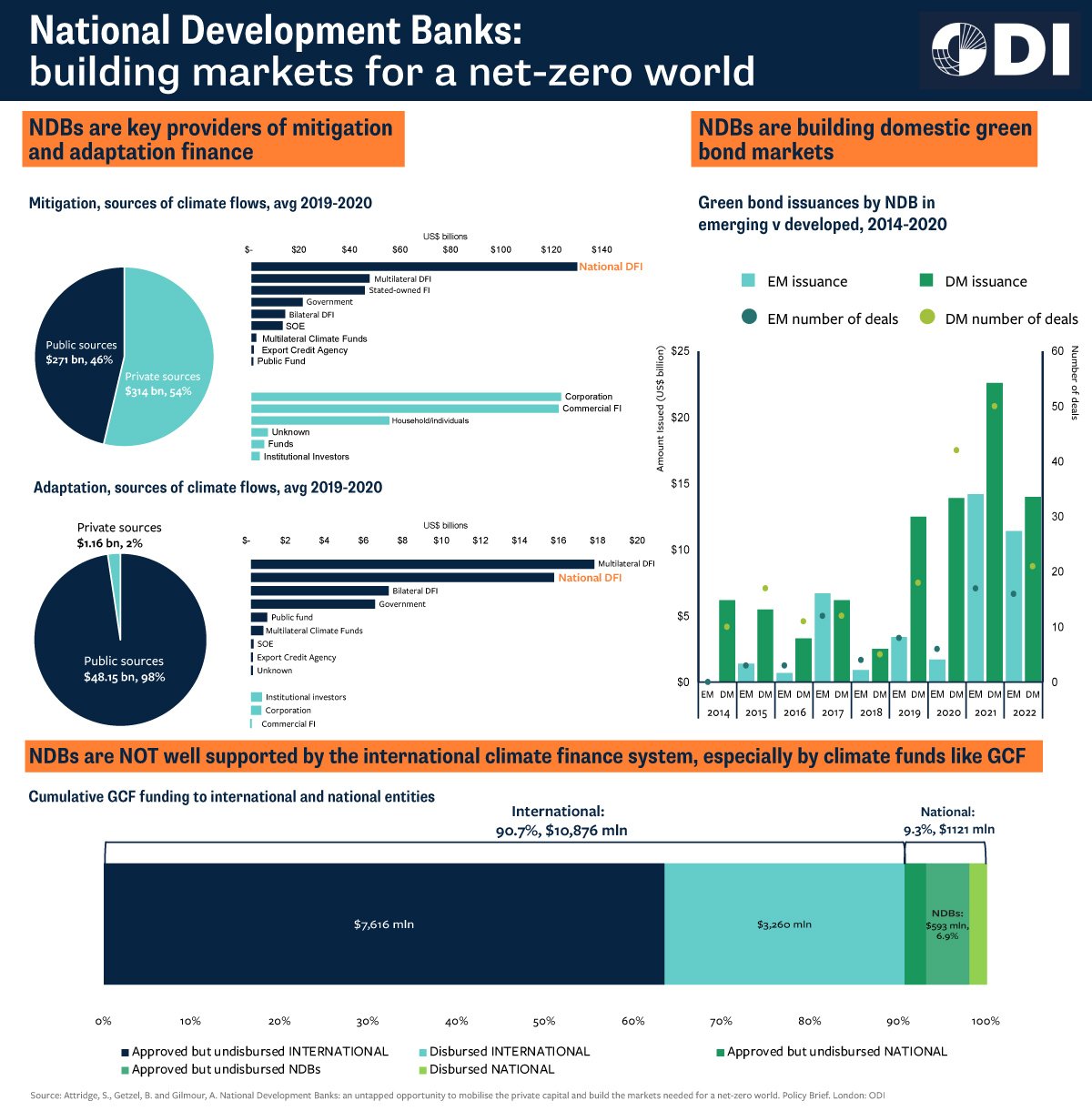

Despite being the largest provider of mitigation finance and second largest provider of adaptation finance, National Development Banks (NDBs) have been largely overlooked as a key player in mobilizing such sums of capital. Access to international climate funds has so far been reserved for the multilateral system. Yet NDBs – with their knowledge of local markets, needs, and capacities – are better placed to make use of such funds. NDBs also have long-held relationships with stakeholders in the markets they operate within which they can leverage to help catalyze investment opportunities.

Building NDBs into the international policy framework for climate and transition finance will help shift the dial towards the kind of sums needed to finance this transformation. This policy brief focuses on EMDE NDBs on one aspect of this transition: their role in supporting and mobilising the private finance required for the transformation of national energy systems. It outlines four key mobilisation roles, highlighting the critical importance of blended finance and access to international climate finance.