This set of Frequently Asked Questions (FAQs) answers questions on the links between future economic development and the consumption and production of oil and gas in low- and middle-income countries. In the context of the global climate emergency, economic prosperity and the eradication of income poverty need to go hand in hand with decarbonisation of the world’s energy systems.

Are oil and gas necessary for economic development?

Oil and gas have helped make some countries rich in the past, but they are not a precondition for economic development in the future. Oil and gas can impact economic development in both positive and negative ways, directly or indirectly. As energy systems can take time to respond to technological change, oil and gas will play a role in the near term. But the availability and lower cost of renewable energy make the development of economies dependent on oil and gas in the medium and longer term unlikely.

What is the link between oil and gas and economic development in poor countries?

In countries that produce oil and gas, investment and extraction activities can directly increase economic activity from the oil and gas sector, but also have indirect negative impacts that hamper economic development. For example, if they are prone to or promote corruption, oil and gas can lock countries into polluting energy systems or harm the development of other industries. Previous economic development pathways that relied on oil and gas paid little attention to their associated negative impacts (see FAQ 3), but these are increasingly coming into focus.

Showing a clear relationship between economic development and oil and gas consumption is just as difficult. Research shows that energy consumption and economic activity are strongly positively correlated in developing countries (i.e. energy consumption grows as gross domestic product (GDP) grows), but the causal relationship is uncertain. It is not always the case that an increase in GDP results in an increase in energy consumption, nor is it clear whether increasing GDP leads to increasing energy consumption, or vice versa.

The effect of oil and gas consumption on economic growth varies according to the type of economy, its main economic activities and how these use different energy sources. Where energy consumption powers activities that generate economic output, the consumption of energy is linked to GDP. This direct link is strongest in the industrial sector, where productivity (output per unit of input) tends to be higher than in other sectors.

Oil and gas together accounted for more than half (56%) of the world’s total energy consumption in 2017. The share in the Africa and Asia-Pacific regions was lower than this, and the share in the Middle East and North America was larger. Oil products have a larger share of total energy consumption than gas in all regions except Eurasia.

Transport is the principal use of oil globally, accounting for 65% of oil consumption in 2017. However, in some regions (the Americas, Europe, and the Middle East), industry is the main use of oil. The industrial share is more pronounced when the non-energy use of oil for manufacture of petrochemicals is included. In the case of natural gas, the main sectors for consumption are industry and residential.

Do poor countries need oil and gas to drive industrialisation?

Industrialisation is powered by energy sources which generate electricity, produce heat and make things move. Oil and gas, along with coal, were readily available as power-generation sources in previously industrialising economies, but we now have alternative technologies using renewable energy sources. These alternatives, and progress in the transition to renewable energy, vary between different energy uses. The transition is largely complete in stationary motors – in the US, for example, 90% of motors are electric – so we focus here on heating and transport. Electricity is discussed in FAQ 2.2.

Heating

Renewable energy is used to warm homes and provide heat to factories and heavy industry today, and in many cases, it is already competitive with burning oil and gas. According to the International Energy Agency, renewables met 10% of total global heat demand in 2018, but must be scaled up rapidly to combat climate change and limit global temperature rise to 1.5ºC.

Most of our heating needs do not require very high temperatures, but oil and gas burn at about 1,000ºC and are therefore an inefficient source of heat for most purposes. A wide range of renewable options including solar thermal, geothermal, and electric heat pumps is available to provide low-temperature heat. Because they have almost no running costs, they are often the most economical option. For example, the Asian Development Bank found that in China it was already cheaper to install solar-powered district heating than natural gas boilers.

Even high-temperature heat for industrial processes is being provided by renewable energy technologies such as concentrated solar, deep geothermal, burning sustainable biomass and renewable electricity. This map shows hundreds of examples of solar-powered industrial heating, including tanneries in Kenya and Thailand, a mine in Chile and textile factories in India.

Transport

Arguably the best way to reduce oil and gas for transport is to manage the demand for transport in cities through better urban planning. Cities that sprawl as they develop often force their populations to commute to the centre from peri-urban areas or the suburbs by oil-powered transport. Policies that avoid urban sprawl can ensure people have access to jobs, goods and services closer to their homes.

Shorter travel distances and safe paths can promote non-motorised transport options such as walking and cycling which, in turn, can reduce air pollution, promote wellbeing and enhance safety. It is also easier in population-dense cities to organise personal and public shared-transport options, from electric bikes and scooters to shared vehicles and bus rapid transport. OECD research shows that switching from individual to shared options could reduce a city’s transport-related greenhouse gas emissions by 30 to 60%. Having fewer vehicles in use more of the time also makes a stronger case for investing in new clean technologies for both public and private sectors. Examples include the more than half-a-million electric buses in operation globally in 2018, Kenya’s fully electric taxi company, and the Indian city of Indore’s buses fuelled by biogas from waste.

Shared transport will not suit everyone, but individual transport also has alternatives to using oil and gas. By 2018, there were already 300 million electric bikes and scooters, and as of 2020, there were 9 million electric cars globally. By 2022, there will be 500 electric car models – with more than 200 already available in China. Analysts are divided on how quickly the sales of electric four-wheeled vehicles will overtake those of fossil fuel-powered vehicles. Some say it will be within the next 10 years, while others project within 20. By 2040, electric vehicles could displace the consumption of 18 million barrels of oil per day.

Decarbonisation of freight transport is lagging behind but even here alternatives to oil and gas already exist. Again, reducing the demand for freight overall by, for example, reducing wastage in the supply chain, or by promoting the consumption of locally produced goods, is an obvious option. For long-distance freight, electric rail and biodiesel-powered road vehicles could reduce diesel demand. Electric local freight services are already on the road, but at a smaller scale than passenger vehicles.

Sustainable biofuels may also displace oil. Currently, global biofuel production is about double the UK’s oil production. Valid concerns around some current producers’ poor record in terms of environmental, social and governance factors mean any expansion would need strong monitoring to ensure environmental, social and climate sustainability. Nonetheless, assuming such concerns can be addressed, the International Renewable Energy Agency is calling for a fivefold increase on today’s levels by 2050.

How does oil and gas production contribute to economic development in poor countries?

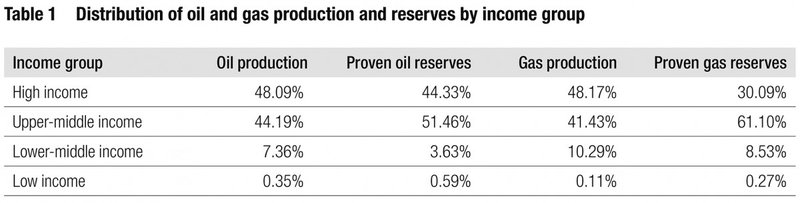

Most middle-income countries produce some oil or gas. The US Energy Information Administration lists 63 as producers of oil and 55 as gas producers in 2018. In many cases, the quantities produced are very small. However, middle-income countries produced just over half the world’s oil and gas in 2017 (see Table 1).

The number of low-income countries listed as producing oil and gas in 2018 was 11 and 8, respectively. Together, they produced less than 1% of the world’s oil and gas.

The production of oil and gas for domestic consumption and export is perceived by many governments in low- and middle-income countries as a way to attract foreign investment, boost economic growth and provide a revenue stream to support economic development in other sectors. However, the economies of countries rich in oil and gas resources have generally performed less well in the past than resource-poor countries. Furthermore, many oil- and gas-producing countries have not been able take advantage of their resource wealth and invest in increasing productivity in other sectors or in establishing strong sovereign wealth funds.

Although not inevitable, the ‘resource curse’ and ‘Dutch disease’ are often given as reasons for the poor economic performance of countries rich in natural resources. The latter occurs when an inflow of foreign money associated with the discovery of new oil and gas resources leads to an exchange rate appreciation, with negative consequences for other traded sectors, and a shift of domestic finance and labour into the oil and gas sector. The ‘resource curse’ in oil- and gas-producing countries describes rent-seeking behaviour by elites, inequalities between districts and ethnic groups within a country, and volatility in earnings. It has been more significant in resource-rich countries with weak institutional development and poor governance.

The relationship between oil and gas production and economic growth in low- and middle-income countries is not straightforward but is affected by governance conditions and the effectiveness of institutions. Similarly, the effect of rents from oil and gas production on income inequality is affected by governance: where high oil and gas rents are associated with corruption, they lead to higher income inequality. However, there is some evidence to suggest that income inequality falls in the short term and increases over time as oil and gas revenues increase. The fall in income inequality is due to the redeployment of factor inputs to the oil and gas sector, reducing growth in other sectors.

Are oil and gas necessary to meet rising electricity demand?

Electricity demand in middle- and low-income countries will increase as incomes and population grow. If these countries build their electricity sectors using polluting energy sources, we have no hope of limiting the rise in global temperature to 1.5ºC. Fortunately, in many parts of the world, technological and social changes are already in place that, if rolled out globally, would limit growth in energy demand, satisfy our energy needs and limit climate breakdown. Energy efficiency, renewables and nuclear power are already deployed at scale and, as costs for renewables and energy storage options continue to fall, the dependence of electricity systems on oil and gas will continue to decline.

In 2017, oil and gas were responsible for 3% and 26% respectively of global electricity generated. This reflects decisions made in previous decades, because of the long lifetime of power plants. Today, renewables are the cheapest source of large-scale power for two-thirds of the global population, and renewable energy is the most-added type of generation, accounting for 62% of total generation capacity added in 2018.

Natural gas is important to current electricity systems and its advocates brand it the ‘cleanest fossil fuel’. A unit of electricity generated using natural gas creates approximately 480 grams of CO2e on average but can rise to 700 gCO2e for ‘peaker plants’ and where natural gas leaks during production (see FAQ 3). The respective values for wind and solar PV are 10 gCO2e and 48 gCO2e. Market forces alone would limit the growth in gas-generated power to just 0.6% per year to 2050, but an even greater reduction is needed to keep below 1.5ºC. Some advocate the use of carbon capture and storage (CCS) to reduce emissions, but no gas-fired power plants yet operate with CCS. They would still lead to greenhouse gas emissions from gas production (see FAQ 3), as well as increasing the cost of electricity generation while the cost of renewables continues to fall.

Oil is already the least efficient way to produce electricity from burning fossil fuels – including from coal. Burning oil is expensive and only used where subsidies make it artificially cheap or historically where alternatives were not readily available.

These changing dynamics are why three of the four scenarios considered in the IPCC Special Report on Global Warming of 1.5ºC above pre-industrial levels have fossil fuels providing less than 20% of electricity in 2050 and no fossil fuel electricity at all in 2100. According to the Intergovernmental Panel on Climate Change (IPCC), renewables can provide 80–90% of power in 2100 and 60–85% in 2050, with nuclear providing the balance. There has been much debate about the feasibility of supplying all electricity from renewable sources by 2050 but two-thirds of experts working in the renewables sector think that 100% renewable energy systems are technically and economically feasible.

Isn’t natural gas a bridge to renewable energy in the future?

Natural gas is not a bridge fuel for electricity generation because its use does not guarantee zero emissions and, in most places, it will be more expensive than renewable energy. The idea that natural gas can be a bridge to low-carbon energy systems is premised on two arguments: first, that natural gas will reduce greenhouse gas emissions if it displaces coal used for power generation; and second, that gas-fired power generation is necessary to provide peak electricity in systems reliant on variable renewable energy sources, such as solar and wind.

Before we examine each of these arguments in turn, it is worth noting that burning natural gas, for electricity generation or thermal energy, produces greenhouse gas (CO2) emissions. The ambition for net-zero energy systems by 2050 requires the complete elimination of these emissions or their secure capture and storage by 2050.

Greenhouse gas emissions

Burning natural gas instead of coal to generate electricity produces fewer CO2 emissions. Coal-fired power plants emit 905 gCO2 per kWh, compared with 404 gCO2 per kWh from the most efficient gas-fired plants. The premise of the bridging fuel argument is that the substitution of natural gas for coal-fired generation would reduce greenhouse gas emissions. According to the International Energy Agency, almost a quarter of the world’s electricity is now generated by burning gas. In 2018, gas-fired generation grew by 4%. The switch from coal to gas, primarily in China and the United States, accounted for a fifth of this increase in gas demand and helped to avert 95 million tonnes (Mt) CO2 emissions.

Although the bridge may have been traversed in the US, but there is little to indicate this happening globally. In 2018, 38% of the world’s electricity came from coal-fired power plants, almost the same as in 2010 (39%). Coal-fired power generation globally grew by 2.6% in 2018, accounting for 30% of global CO2 emissions and the largest contributor to growth in total emissions.

The potential to switch from coal to gas for power generation also varies between countries. Few low-income countries use coal for power generation. Among middle-income countries coal accounted for about half of power generation in 2015. Some did not use any gas for electricity generation in 2015 and would need to invest in gas-supply infrastructure to use gas in new power plants. This would lock them into this infrastructure for many years and it would not necessarily be the most cost-effective solution.

The cost of gas-fired power generation is also no longer lower than renewable alternatives. In the US in 2019, the unsubsidised Levelized Cost of Energy (LCOE) using gas was $56 per MWh, compared with $40–$41 per MWh for wind and solar. The International Renewable Energy Agency (IRENA) estimated the global weighted-average LCOE of solar PV at $85 per MWh in 2018, and the equivalent for wind at $56 per MWh. These figures illustrate that solar and wind power costs are frequently within the cost range of fossil fuel power.

In terms of the impact of using gas on emissions reduction, comparison between emissions from coal and gas often overlooks upstream emissions from gas extraction and transport. These emissions account for about 25% of the full life-cycle emissions of natural gas. Fugitive emissions (i.e. leaks and irregular releases of gas) and venting (intentional releases) account for most upstream emissions. The emissions are mainly methane (CH4) which has a much greater global warming potential than carbon dioxide (CO2). Recent research suggests that, globally, methane emissions from human activity have been underestimated.

Taking upstream emissions into account, CO2e emissions from gas-fired generation are more than double those from using coal, over a 20-year timeframe. Over a 100-year timeframe, emissions from a combined cycle gas turbine (CCGT) plant are 28% lower than coal, and for an open cycle gas turbine (OCGT) plant only 8% lower. The principal reason for the difference between the two timescales is that CH4 emissions from gas production and transport remain in the atmosphere for a shorter period than CO2 emissions. However, achieving a maximum 1.5°C global average temperature rise depends on immediate emission reductions.

Carbon capture and storage (CCS) technology has been suggested to enable the continuation of gas-fired power generation. Without CCS, gas would have to be eliminated from power generation by the middle of the century. However, CCS has several disadvantages, apart from being unproven in a gas-fired power plant. First, it is energy-intensive, requiring 25% to 50% more energy for the same electricity output. Second, there would be a risk of leakage from carbon-storage facilities; and, third, it would not capture upstream CH4 emissions, which would be higher per kWh generated as a result of CCS’s energy intensity. The long-term governance of CCS storage sites and the complexity of the liability frameworks needed to address any leakages also make this a complex and potentially costly approach. The use of CCS would also increase the cost of gas-fired electricity generation.

Isn’t gas needed to balance electricity supply and demand?

The variability of renewable energy sources, such as the sun and wind, and the need to avoid interruptions in electricity supply are used to argue that thermal power will be needed to balance supply and demand. However, renewable energy generation combined with demand management and storage mean that gas-fired generation is not necessary to balance electricity supply and demand.

The amount of electricity generated by renewables can vary throughout the day so grid operators use weather models to forecast how much power will come from renewables and then add in power from other sources so power supplied to the grid matches demand. If renewable power supplies are interrupted by variation in solar intensity or wind speed, thermal power can be quickly turned on to meet any shortfall, particularly during hours of peak electricity demand. Gas-fired power, it is argued, is particularly suitable for the rapid ramping up of electricity supply and produces fewer emissions than coal.

Today, many countries use gas as a balancing fuel because they have large centralised grids with gas power plants already connected. Where electricity is provided by decentralised or off-grid power sources, large gas power stations are unlikely to provide flexibility. In the future, gas power plants that used to provide ‘baseload’ power will increasingly run at part-load to play this balancing role. Existing gas power stations that have already recovered their capital costs can be a cheap way to balance the grid, though even then, many require subsidies. This is not the case for new gas power stations because they also have to factor in the financing costs.

The most efficient gas power plants use CCGT technology. However, the ramp-up rate of a CCGT plant is much slower than for an OCGT plant. The viability of a CCGT plant depends on a high utilisation rate, which could not be achieved if the primary purpose were peak power generation. Although most new gas-fired power stations deploy CCGT, the technology is unsuitable for rapidly balancing electricity supply and demand.

Instead, countries have a range of options to manage both the supply of and demand for electricity which, individually or in combination, reduce the need for gas for balancing. In addition, increased energy efficiency makes balancing easier because reducing aggregate demand reduces the complexity of managing the grid.

Variable renewable generation can be effectively integrated into electricity systems without the need for gas-fired power to supply peak capacity. Technologies for storing electricity, such as lithium batteries and hydrogen fuel cells, have developed rapidly in recent years and their cost has fallen. They can supplement electricity generation from renewables. In Florida, for example, the cost of a system using batteries combined with wind and solar power is lower than a gas-fired system. In southern Australia, batteries with over 100 MW capacity are being installed alongside solar PV arrays.

Increasingly, service operators are balancing supply and demand by managing the demand side of the electricity service as well as the supply side. In many developing countries, load shedding (forced disconnection of consumers) occurs when demand outstrips supply. This crude way of managing the power grid hampers access to electricity for many, but the principle can be useful if, as in many developed countries, consumers (industrial, commercial or residential) can opt to be paid to temporarily reduce their demand or schedule high-consuming activities to times when the grid is more likely to have spare capacity.

Does the production and consumption of oil and gas reduce income poverty and inequality?

Research evidence clearly shows that energy consumption and income are correlated, at national and household levels. However, we cannot say that more income always leads to more energy consumption or that the consumption of oil and gas reduces income poverty.

Poor and vulnerable people are less likely to consume modern energy services (see FAQ 1), including those from oil and gas. But many households that are not income poor are energy poor, and where safety nets protect consumption of energy by the poorest, households can be income poor but not energy poor. Moreover, poverty status is dynamic – so households can move in and out of income and energy poverty as income and energy needs vary over time – and multi-dimensional (e.g. deprivation is affected by access to health or education services (see FAQ 1)).

Energy consumption can reduce income poverty when it provides or enhances opportunities to generate income or reallocate it. In general, when a household gains access to electricity this can increase opportunities to generate income, if combined with other interventions, but the magnitude of the impact varies between countries and is not dependent on the source of primary energy. We also do not know how much electricity access historically was due to oil and gas. However, these fuels will have less relevance in the future because most households without electricity access will gain it via renewable energy sources (see FAQ 1).

There is even less evidence for the relationship between income poverty and energy consumed for cooking. A detailed review by World Bank researchers found that ‘virtually no study on cooking has attempted to quantify the impact of adoption of modern energy on income or total household expenditure’.

At a global scale, consumption of oil and gas is highly unequal and the negative impacts of this consumption (see FAQ 3) are felt most strongly by those who are poor. The IPCC is clear that in general the more we limit global heating, the easier it will be to ‘eradicate poverty and reduce inequalities’ while also noting that ‘efforts to reduce poverty and gender inequalities … can reduce vulnerability to climate change’.

Do oil and gas provide a valuable source of revenue for governments?

The prospect of fiscal revenues from oil and gas resources is one of the main reasons why governments encourage and license their exploration. When production does take place, often several years after the discovery of viable reserves, revenues can be significant and potentially transformative. However, oil- and gas-producing economies do not necessarily perform better than non-producers and, in many cases, perform worse.

Governments receive revenue from oil and gas through two main routes: fuel taxes earned on retail fuel sales (e.g. excise tax and VAT) and, in producing countries, revenues from upstream oil and gas activities (including royalties, corporate taxes and service fees). In some countries, governments subsidise fuel sales or provide incentives for exploration and production, reducing total net revenues from oil and gas.

Governments typically take a significant share of total upstream revenues from oil and gas exploration and production. Between 1998 and 2012, this share averaged 45.5% across 31 producing countries. An analysis covering the period of high oil prices between 2000 and 2014 found the share of total revenues taken by governments to be 52% on average. However, the government share taken varied between countries, from more than 70% to less than 20%.

Government revenues from oil and gas, and their share in total revenues, are affected by the type of agreement between governments and oil and gas companies. Concession agreements give companies ownership of oil reserves and potentially large returns but may be subject to changes in policy. Production-sharing agreements and service contracts are also used, the latter usually providing more to governments.

Payments for production entitlements – the government’s share of oil or gas production – are often made in-kind (i.e. physical quantities of oil and gas) to national oil companies (NOCs). In many countries, such payments in-kind account for most of the revenue governments receive from oil and gas production. Data from 30 countries found that NOCs transferred less than a quarter of their total revenue (22%) in 2016 – $349 billion from a combined total revenue of $1.6 trillion. In the 10 countries with the most oil sales revenue, sales by NOCs accounted for 65% of the total government revenue.

Revenues retained by NOCs are subject to less scrutiny than government expenditure (e.g. by parliamentarians), with less transparency about how they are managed. In 2016, 79% of NOCs’ oil sales were in countries with low scores in the 2017 Resource Governance Index (RGI), and countries with a large oil sales revenue relative to overall government revenue tend to have a low RGI score (e.g. Algeria, Angola and Nigeria).

Governments in producing countries have two main revenue challenges: ensuring a consistent and predictable flow of revenue and ensuring the effective deployment of revenues. Volatility in revenue can come from variations in production or, more likely, fluctuations in oil prices. Price fluctuations are a greater challenge for governments which depend on oil and gas for a large proportion of their total revenue.

Governments can choose to spend revenues or save them for the future. The level of development in the country (in terms of accumulated capital) and the expected duration of revenue generation are key factors influencing this choice. In countries where capital is scarce (e.g. low- and lower-middle-income countries) and oil and gas revenue will be short-lived, governments should strike a balance between spending to develop other sectors and saving. If their revenues are expected to be long-lasting, more emphasis can be given to spending in the short term.

In practice, low-income resource-rich countries tend to have a low savings rate, and much of their spending is not investment for the future. Public investment as a proportion of GDP is lower in resource-rich low-income countries than in other low-income countries. Investment of oil and gas revenues can also be wasteful, due to poor governance, including corruption, or limited capacity in the public sector.

Many oil- and gas-producing countries subsidise their consumption and globally, in 2018, these subsidies totalled more than $250 billion. For importing countries, this decreases fiscal resources that could otherwise be used for development. For net exporters of oil and gas, the desire to keep domestic prices below those of the international markets represents foregone revenue that could, indirectly, have been used for other development priorities.

Does the oil and gas industry provide many jobs in developing countries?

Globally, about six million people are directly employed in the petroleum sector, according to the International Labour Organisation (ILO). Indirect employment in the sector’s supply chains is estimated to be more than 60 million. Investopedia estimates that approximately four million people are employed in oil and gas exploration and production globally.

Detailed information about employment in oil and gas production across countries is not readily available. These figures are subsumed into international statistics for mining and industry. Some countries publish national employment data for oil and gas production, including indirect and induced employment (e.g. the UK), while estimates are available for other countries. Differences in categorisation and dates across countries prevent their aggregation.

Compared to other economic sectors, such as agriculture, industry and commercial services, oil and gas production does not create many jobs directly. Most of the jobs in extractive industries are short-term and occur during the development stage when the construction and installation of drilling rigs take place. Exploration and appraisal of resources involves a small number of highly skilled jobs. The production stage, which may have the longest duration, also entails a relatively small number of skilled jobs. During closure and decommissioning, the number of jobs increases again.

To understand the overall job-creation impact of oil and gas production, it is necessary to consider indirect employment (jobs in the supply chains of oil and gas companies) and induced employment (jobs in providers of goods and services purchased by those employed in oil and gas production). The number of indirect and induced jobs created can be significant. In the UK, for instance, total direct employment in the offshore oil and gas industry was about 30,600 in 2019: indirect employment was 121,000 and induced employment was estimated to be 117,500. However, employment multiplier estimates can vary significantly between countries and methodologies.

In developing countries, where oil and gas production may be undertaken by international oil companies, a further consideration is whether direct and indirect jobs are held by citizens or foreign nationals. In Ghana, for instance, 81% of the 6,900 jobs in upstream oil and gas in 2015 were held by citizens and 19% by expatriates; however, there was a much higher proportion of expatriates in highly skilled, and therefore better paid, jobs. The local content provisions of exploration and production licences can influence this, but the oil and gas industry is unlikely to solve the unemployment challenge facing many developing countries.

More than three-quarters of those employed in the oil and gas sector are male. The proportion of women in senior and executive jobs is lower than in entry-level positions. In national oil companies, the proportion of women is lower than in international oil companies.

The impact on jobs of phasing out oil and gas

Employment levels in the oil and gas sector fluctuate, overall and at a local level. The number of people employed in oil and gas production is strongly correlated with oil prices. In 2015 and 2016, for example, more than 440,000 jobs were cut due to low oil prices and oversupply, primarily in the US and the UK. Employment in the sector is also being driven down by automation in extraction, consolidation within the industry, and regional shifts (associated with differentials in costs).

IRENA estimates that 8.2 million fossil fuel jobs (coal, oil and gas) would be lost by a transition to renewable energy by 2050. However, these would be outweighed by the increase in employment in the renewable energy sector, which employed more than 11 million people worldwide in 2018, and could reach 42 million by 2050. Renewable energy for electricity generation employs more people than fossil fuel generation per unit of installed capacity, per unit of power generated and per dollar invested. As jobs in fossil fuels reduce, the creation of renewable energy job opportunities must be managed to mitigate the impact on workers and their families.

Does the oil and gas industry face climate risks in developing countries?

Two related threats make the future of the sector less certain that it has been. One is the unpredictability of prices for oil and gas exports, with a risk of low prices for a sustained period. The second threat comes from actions to address the global climate crisis which reduce demand.

Expansion of oil and gas exploration and production in the period of high prices before 2014 has been followed by low prices – and a further drop to less than $35 a barrel in March 2020, one third of the price in 2013. The low price is a challenge for governments dependent on revenues from production, or those expecting future revenues, as well as a challenge for companies with relatively high production costs. In many developing countries, the costs of production are higher than in other regions, putting them at a disadvantage in a more competitive international market.

Analysis suggests that, at the very least, a third of the world’s oil reserves and half of its gas reserves would need to remain in the ground if the goals of the Paris Agreement are to be achieved. Recent analysis suggests far greater emissions reductions are needed. Global demand for oil is expected to peak during the 2020s, as renewable electricity generation is cost-competitive in most places and vehicles are increasingly electrified. However, recent and new investments in oil and gas may take a long time to generate viable returns, longer than meeting climate targets would allow, and are therefore at risk of being ‘stranded’.

If alternatives exist, why do rich-country donors and governments still support oil and gas development in poorer countries?

Governments committed in the Paris Agreement to ‘making finance flows consistent with a pathway towards low greenhouse gas emissions and climate-resilient development’. This aim (also known as Article 2.1c) is fundamental to limiting the global temperature increase and our capability to adapt to climate change (Articles 2.1a and 2.1b, respectively). To achieve the goals of the Paris Agreement, finance for climate-compatible investment needs to be scaled up and finance for carbon-intensive investment needs to be scaled down.

National governments are starting to base infrastructure investment decisions on climate impacts. For example, a gas terminal was rejected in Sweden and in the UK at least three airport expansion plans – Bristol, Stansted and Heathrow – have been rejected. The EU, however, provides a clear example of the challenges. In late-2019, the European Investment Bank announced it would no longer fund oil and gas projects without measures to prevent their GHG emissions and the European Commission launched the European Green Deal. But in early-2020 the European Council backed an infrastructure plan allowing more than 35 oil and gas projects to apply for public finance.

International support for the energy transition has been slower than domestic climate action in some countries. Although France’s national development bank committed in 2017 to make its activities 100% consistent with the Paris Agreement, China explicitly includes oil and gas extraction as an encouraged form of outbound investment. Likewise, 60% of the UK’s support for energy in developing countries between 2010 and 2017 was for fossil fuels. It was only in 2019 that the UK agreed that it should align its aid budget with the Paris Agreement and is only now starting to question whether other international policies (e.g. trade deals) are harmful to global climate change action. As two UK parliamentary committees noted in 2019, there is a lack of coherence on tackling climate change across different ministries.

To make financing consistent with the aims of the Paris Agreement, historical convention and vested interests supporting oil and gas need to be addressed. Key barriers within institutions include a lack of capacity to adopt renewables, people and systems ‘doing what they’ve always done’, and pervasive imperfect information. Overcoming these barriers is made even harder by immense pressure from incumbent oil and gas industries. Since the Paris Agreement was signed, the five largest oil and gas companies have spent nearly $200 million per year lobbying governments to block or delay climate-motivated policy. These challenges exist in the public sector too: powerful state-owned oil and gas companies form part of government ministries in many countries.

Andrew Scott and Sam Pickard